You earn 60000 in the 2022 to 2023 tax year and pay 40 tax on 10000. This means that when you retire and do not have any other taxable income and relief you can withdraw up to 40000 per year from your SRS account tax-free on or after.

Auto Enrolment Tax Relief Workplace Pensions Aviva

An age-related earnings percentage limit.

. Principal Private Residence PPR Relief. Talk to our skilled attorneys about the Employee Retention Credit. You will be able to deduct up.

End Your Tax Nightmare Now. 2000 will be eligible for tax relief in view. We need to calculate the tax.

Get free competing quotes from the best. People may also retire when they are eligible for private or public pension benefits. Ad Well Help Build The Financial Plan And Investment Strategy You Need Based On Your Goals.

We Help Taxpayers Get Relief From IRS Back Taxes. Ad Read Expert Reviews of Tax Relief Services. You put 15000 into a private pension.

You automatically get tax relief at source on the full 15000. ESS - Rollover relief. Learn More From One of Our Trusted Financial Advisors Today.

Make an Informed Purchase. Enjoy additional personal tax relief. Find and Compare the Best Tax Relief Based on Price Value Ratings Reviews.

What is the Private Retirement Scheme PRS. First things first whats a private pension. How to Calculate Tax Relief Under Section 891 on Salary Arrears.

Tax relief for employee pension contributions is subject to two main limits. What is a Private Retirement Scheme PRS. Ad 5 Best Tax Relief Companies 2022.

Child aged below 18. Tax Relief for Child i Ordinary Child Relief. What is the Private Pension Tax Relief.

PRS Income Tax Relief. Retirement is the withdrawal from ones position or occupation or from ones active working life. Withdrawal from Supplementary Retirement Scheme SRS Account Foreigners.

Child aged above 18 with following condition. Limits for tax relief on pension contributions. While Mr Ong would like to make a cash top-up of 8000 to his own CPF Special Account the amount of top-up allowed to be made is only 2000.

Besides being an additional retirement pot the PRS is also income tax deductible. Learn More From One of Our Trusted Financial Advisors Today. In 2016 Sen.

SRS contributions made on or after 1 Jan 2017 are subject to a cap on personal income tax relief of 80000 per Year of Assessment from Year of Assessment 2018. Below are the detailed steps to calculate the relief under section 89. Ad Dont Face the IRS Alone.

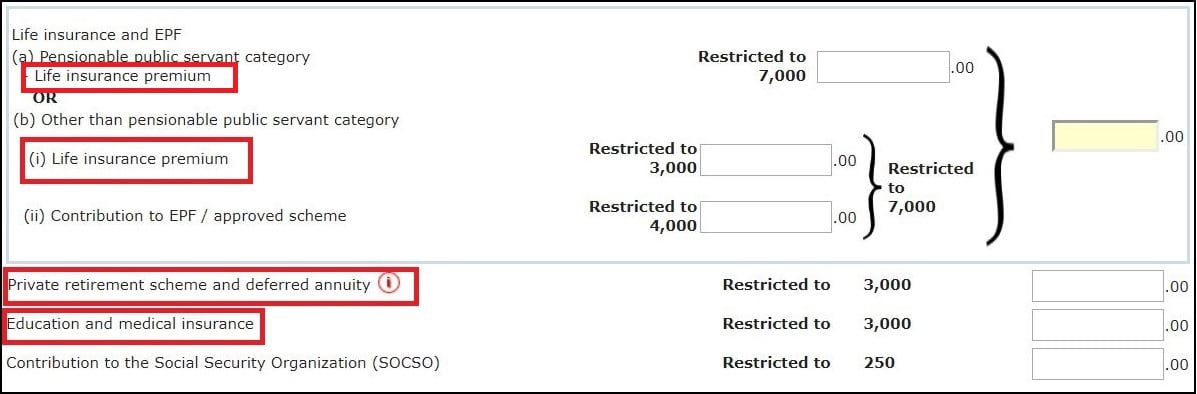

Its basically a savings scheme that you pay into for when you retire. To encourage the reinvestment of the capital gains that are made on the sale of the capital assets through the seller the Indian government has given the relief. You can claim tax relief of up to RM3000.

Ad Unsure if You Qualify for ERC. You can get up to RM3000 personal tax relief annually on top of the RM6000 annual tax relief for EPF contribution and life insurance premiums. Capital Gains Account Scheme.

Get A Free Tax Relief Consultation To Eliminate Tax Debt. Taxi DriversPrivate-Hire Car Drivers Submit Income. ESS - Foreign income exemption for Australian residents and temporary residents - employee share schemes.

100 Money Back Guarantee. Ad Based On Circumstances You May Already Qualify For Tax Relief. You May Qualify to be Forgiven for Thousands of Dollars in Back Taxes.

Receiving full time education diploma and. Ad Well Help Build The Financial Plan And Investment Strategy You Need Based On Your Goals. A Principal Private Residence PPR is a house or apartment which you own and occupy as your only or main residence.

Ron Wyden an Oregon Democrat floated a detailed reform plan and said Its time to face the fact that our tax code needs a dose of fairness when it comes to. However unlike the state pension which. Resolve your tax hardship issues permanently.

Ad Honest Fast Help - A BBB Rated. PRS is a voluntary investment scheme to help you save for retirement. The total personal income tax relief claimable in a year from the Year of Assessment 2018 is S80000.

SRS contributions made on or after 1 Jan 2017 help maximise the total amount of.

Workplace Pension Contributions The People S Pension

A Guide To The Private Retirement Scheme Prs

How To Claim Income Tax Reliefs For Your Insurance Premiums

Do You Pay Tax On A Sipp How Much Tax Will You Pay

What Is Pension Tax Relief Moneybox Save And Invest

Tax Relief Statistics December 2021 Gov Uk

Tax Relief Statistics December 2021 Gov Uk

Tax Relief Statistics December 2021 Gov Uk

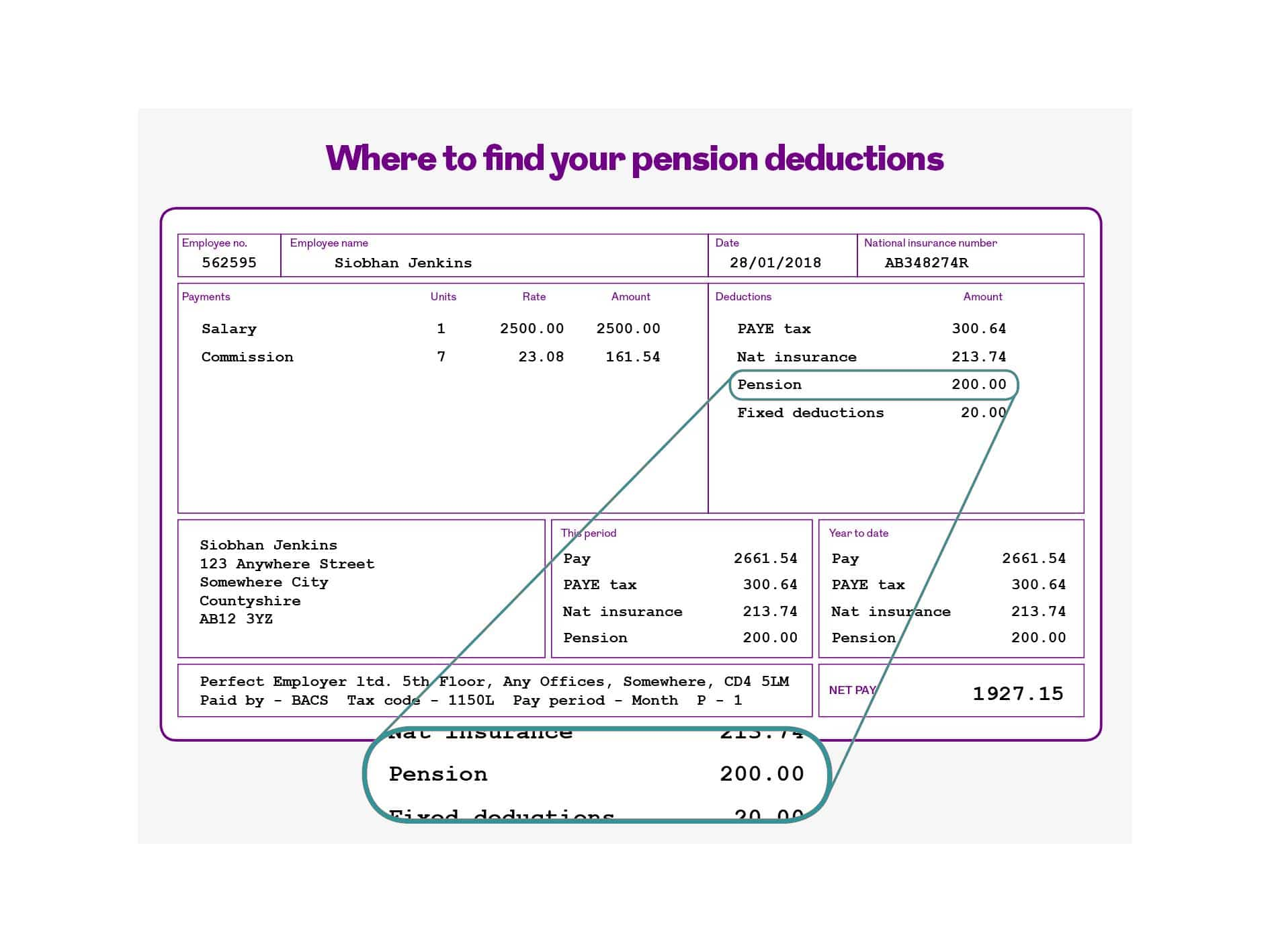

How To Read Your Payslip Pension Deductions Royal London

Types Of Income In Retirement Low Incomes Tax Reform Group

Pension Jargon Buster Low Incomes Tax Reform Group

How Does Retirement Work In Switzerland The Swiss Pension System Credit Agricole Next Bank

Can You Withdraw Money From A Private Pension Penfold Pension

What Is Pension Tax Relief Moneybox Save And Invest

How To Claim Higher Rate Tax Relief On Pension Contributions Unbiased Co Uk